[ad_1]

Featured image from Breakingpic on Pexels

The moving average indicator is a widely used technical indicator in Forex trading, as traders can use it in a variety of ways.

The main reason behind the popularity of this MT4 indicator is its simplicity. For one thing, the mathematical calculations behind it are easy to understand. Therefore, traders at all levels find it a comfortable indicator to use in their Forex trading.

Initially, most Forex traders use moving averages in a moving average crossover strategy. However, this versatile indicator can be used in other ways as well. In this article, we outline several ways you can use it.

RELATED ARTICLE: DO YOU NEED THE MACD FOR YOUR FOREX TRADING?

The Moving Average Reflects the Average Price

Simply put, the moving average is a reflection of the average price. As a result, it indicates more about the past than about the future.

In other words, moving averages show the average price of the instrument over a period of time. Therefore, they tend to reflect the trends in the past. However, they’re not great at predicting market trends. This is crucial to understand with this MT4 indicator.

It Identifies Dynamic Support and Resistance Levels

However, the moving average indicator is good at identifying dynamic support and resistance levels. Traders typically use the 200- and 50-day moving averages on the daily chart time frame. And because so many traders use these indicators, they tend to act as dynamic support and resistance levels.

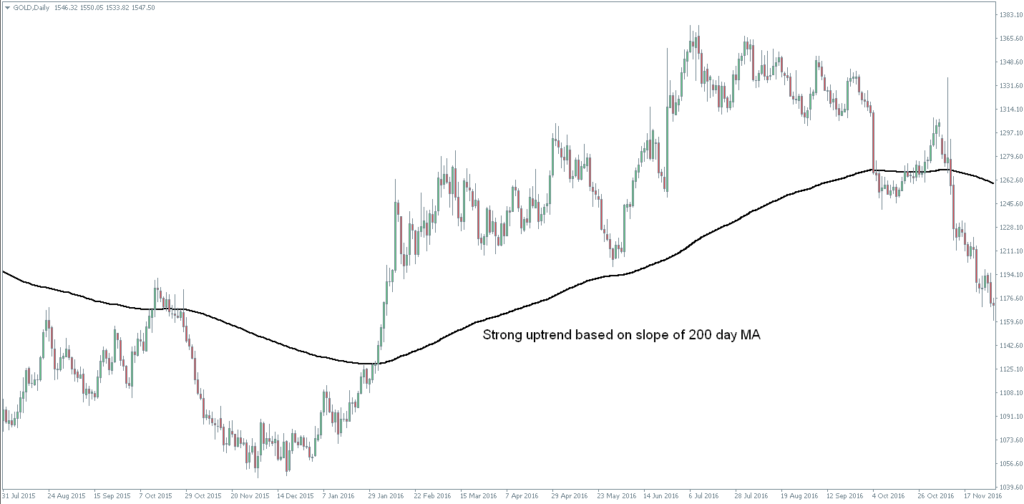

For example, the chart above shows an instrument on the daily time frame. Here you can see how the indicator tends to act as support and resistance for the prices. Of course, you could use a moving average on any period of time that you choose.

The Slope Reflects the Momentum of Price Changes

The slope of the moving average reflects the intensity or the momentum of price changes. For example, when the moving average is sloping steeply, you know that the price is declining or rising quickly.

This can tell you a lot about the momentum of the market. It can even help you to identify the fundamental factors behind such a move.

However, many Forex traders make the mistake of viewing the slope of the moving average as something that is currently happening, instead of something that has already happened. If, on the other hand, a trader uses this indicator correctly, they can gain an edge in the Forex market.

Watching Reversions to the Mean Helps Traders Avoid Extremes

In finance, mean reversion refers to the tendency of an instrument’s value to change over time. Over a long period of time, the price tends to gravitate to its long-term average value.

Just as the moving average tells us more about the past than the future, neither is the concept of mean reversion predictive in nature. Further, mean reversion can behave differently with different asset classes.

All the same, depending on how you look at it, prices do tend to correct to the long-term mean after extreme moves.

A 200-day moving average can show a good example of mean reversion. That is, prices that have moved significantly away from the long-term mean do tend to revert to the mean price over time.

While you really shouldn’t use the mean reversion as the basis for building a Forex trading strategy, you could still apply the concepts in various ways. For example, watching it could help you to avoid buying near extreme highs or lows.

The Moving Average Indicator Is Useful in Several Systems

As you can see, the moving average indicator can be useful in Forex trading strategies. Additionally, traders can use it to help with advanced math-based trading systems as well.

The post The Moving Average Indicator in Forex Trading appeared first on Business Opportunities.

[ad_2]

Source link

Leave a Reply