[ad_1]

8 min read

This story originally appeared on The Conversation

By William G. Bain , University of Pittsburgh ; Georgios D. Kitsios , University of Pittsburgh , and Tomeka L. Suber , University of Pittsburgh

A year ago, when US health authorities issued their first warning that COVID-19 would cause serious “disruptions to everyday life,” doctors had no effective treatments to offer beyond supportive care.

There is no quick cure yet, but thanks to an unprecedented global research effort, various treatments are helping patients survive COVID-19 and stay out of the hospital entirely.

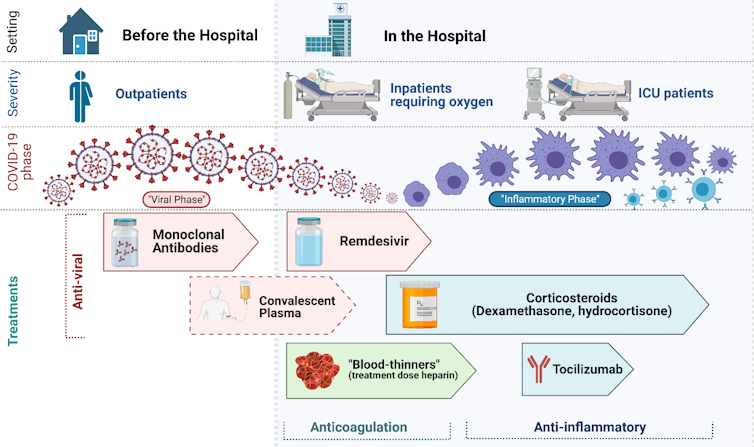

These address two general problems : the ability of the coronavirus to spread through the body, and the damage caused by the body’s immune system response.

When the virus enters the body, it takes over cells and uses them to replicate. In response, the body sends inflammatory signals and immune cells to fight the virus. In some patients, that inflammatory response can continue even after the virus is under control, leading to damage to the lungs and other organs.

The best tool is prevention, including the use of masks , masks and vaccines. The injections train the immune system to fight off attackers. With less risk of uncontrolled infection, they can reduce the risk of death from COVID-19 to almost zero . But vaccine supplies are limited, even with a third vaccine now licensed for use in the US , so treatments for infected patients remain crucial.

As a physician and physicians working with COVID-19 patients , we have been following drug trials and success stories. Here are six commonly used treatments for the disease today. As you will see, time matters.

Treatments that can keep you out of the hospital

Two promising types of treatments involve injecting antiviral antibodies into high-risk COVID-19 patients before the person becomes seriously ill.

Our bodies naturally create antibodies to recognize foreign invaders and help fight them. But the production of natural antibodies takes several days, and SARS-CoV-2 – the coronavirus that causes COVID-19 – replicates rapidly.

Studies show that injecting patients with antibodies soon after symptoms start can help protect against serious infections.

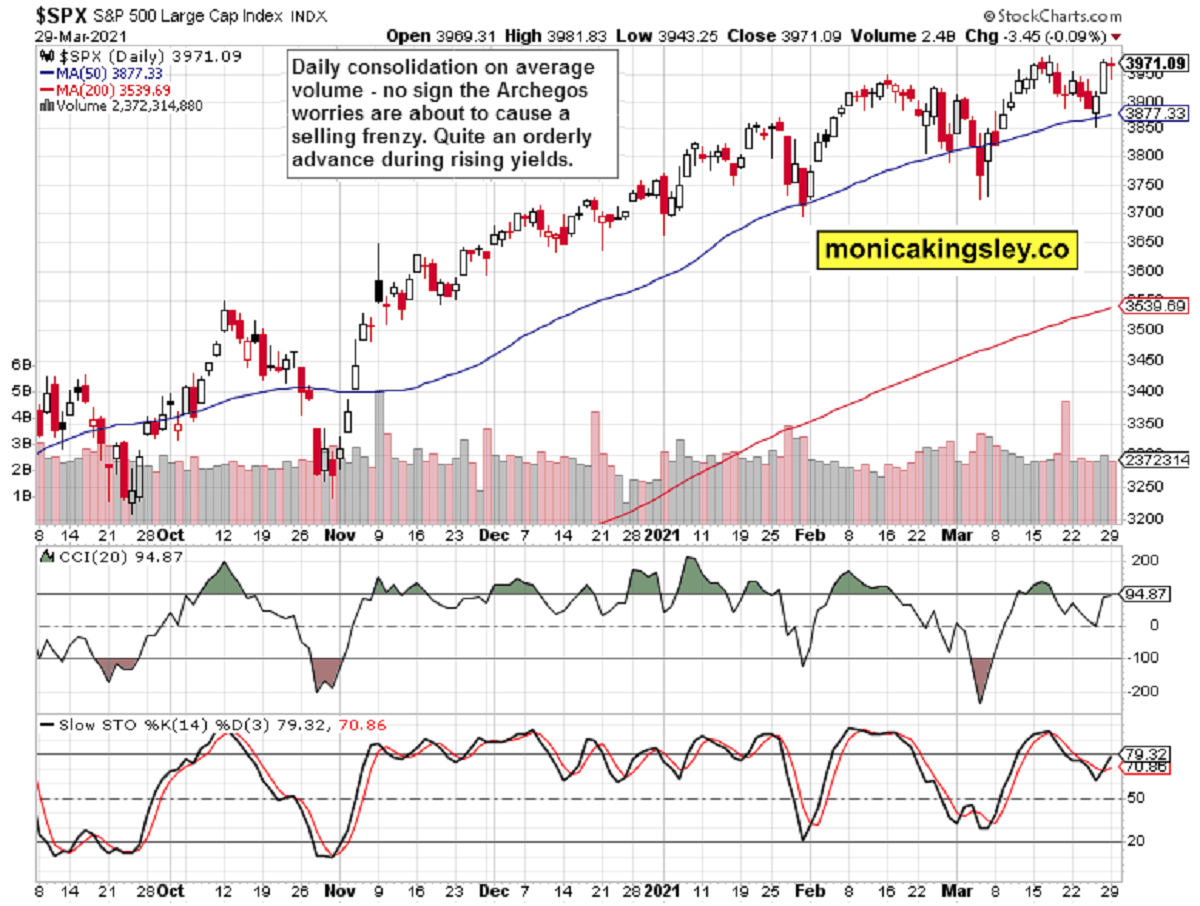

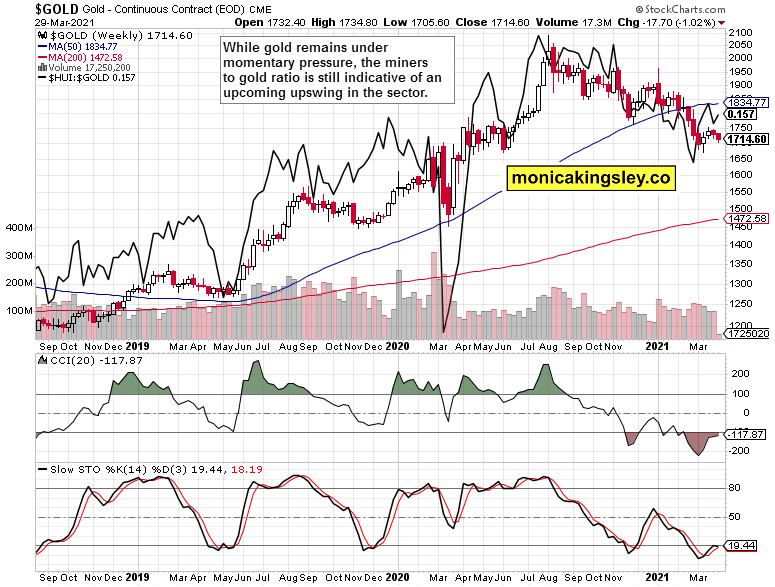

Treatments for COVID-19 and at what height are they used / Image: Georgios D. Kitsios , CC BY-ND

Monoclonal antibodies

These laboratory-engineered antibodies can bind to SARS-CoV-2 and prevent the virus from entering and infecting cells. They include Bamlanivimab and the combination therapy casirivimab / imdevimab developed by Regeneron.

The FDA, the United States health agency, granted emergency use authorization for these therapies because they have been found to protect high-risk patients from hospitalization and death.

However, once patients are sick enough to need hospitalization, studies have not found a proven benefit from them.

Convalescent plasma

Another way to administer antibodies involves drawing blood from patients who have recovered from COVID-19. Convalescent plasma is administered primarily in research settings because the clinical evidence so far is mixed.

Some trials show benefits in the early stages of the disease . Other studies have shown no benefit in hospitalized patients .

Convalescent plasma may play a role as an adjunct therapy for some patients due to the growing threat of mutated SARS-CoV-2 variants , which can evade monoclonal antibody therapy. However, careful research is necessary.

Inpatient treatments

Once people get so sick that they have to be hospitalized, the treatments change.

Most have shortness of breath and low oxygen levels. Lack of oxygen occurs when the virus and the corresponding immune response injure the lungs, causing inflammation of the lung alveoli that restrict the amount of oxygen entering the blood.

Those hospitalized with COVID-19 generally need supplemental medical oxygen to help them breathe. Doctors typically treat patients receiving oxygen with the antiviral agent remdesivir and anti-inflammatory corticosteroids.

Most people hospitalized with COVID-19 have shortness of breath and low oxygen levels / Image: AP Images / David Goldman

Remdesivir

Originally designed to treat hepatitis C, it prevents the coronavirus from replicating by interfering with its genetic components .

It has been shown to shorten the length of hospital stays , and doctors may prescribe it to patients receiving oxygen shortly after arrival at the hospital.

Corticosteroids

Steroids quell the body’s immune response and have been used for decades to treat inflammatory disorders.

They are also widely available, cheap, and well-studied drugs, which is why they were among the first therapies to enter clinical trials for COVID-19.

Several studies have shown that low-dose steroids reduce deaths in hospitalized patients receiving oxygen, including the sickest patients in the intensive care unit.

Following the findings of the landmark RECOVERY and REMAP-CAP studies, steroids are now the standard of care for hospitalized COVID-19 patients who are treated with oxygen.

Blood thinners

Inflammation during COVID-19 and other viral infections can also increase the risk of blood clots, which can cause heart attacks , strokes, and dangerous blood clots in the lungs .

Many patients with this disease are given anticoagulants heparin or enoxaparin to prevent clots from forming before they occur.

Early data from a large trial of COVID-19 patients suggests that hospitalized patients benefit from higher doses of blood thinners.

Some patients get so sick that they need special care to receive high levels of oxygen or a ventilator to help them breathe.

There are several therapies available for intensive care patients, but patients have not been found to benefit from high doses of blood thinners.

Treating the sickest patients

Intensive therapy patients with COVID-19 are more likely to survive on steroids, studies show. However, low-dose steroids alone may not be enough to curb excessive inflammation.

Tocilizumab

It is a laboratory-generated antibody that blocks the interleukin-6 pathway, which can cause inflammation during COVID-19 and other illnesses.

New results from the REMAP-CAP trial that have not yet been peer-reviewed suggest that a single dose of tocilizumab given within one to two days after ventilation reduced the risk of death in patients already on low-dose steroids.

Tocilizumab has also been shown to benefit patients with high levels of inflammation in early results from another trial .

These innovative therapies can help, but careful supportive care in intensive care units is also crucial. Decades of extensive research have defined basic management principles to help patients with severe lung infections who need ventilators.

These include avoiding under-inflation and over-inflation of the lung by the ventilator, treating pain and anxiety with low levels of sedative medications, and periodic placement of certain patients with low oxygen levels in the abdomen , among many other interventions. The same key principles are likely to apply to COVID-19 patients to help them survive and recover from a critical illness that can last for weeks or months.

Medical progress since the beginning of the pandemic has been impressive. Doctors now have vaccines, high-risk outpatient antiviral antibodies, and various inpatient treatments. Continued research will be crucial to improving our ability to fight a disease that has already claimed more than 2.5 million lives worldwide.

This article was translated by El Financiero . This article is republished from The Conversation under a Creative Commons license. Read the original article .

[ad_2]

Source link