[ad_1]

Photo by Aleksi Räisä on Unsplash

Bitcoin is growing more popular by the day, and its future is brighter than ever. Moreover, it holds significant benefits for businesses. For example, the cryptocurrency can cut costs linked to transactions. Have you been thinking it’s time for your online business to accept Bitcoin? This article sheds light on moving your online enterprise toward accepting this cryptocurrency.

Why

Businesses Accept Bitcoin

One of the primary reasons that businesses begin assimilating Bitcoin into their payment means is that it reduces transaction charges. For example, Bitcoin can decrease the fee for credit card processes to less than one percent.

Another factor is that this cryptocurrency does not have charge backs. Instead, it has irreversible transactions. As such, it automatically shuts out the returns or charge backs that occur with bank dealings and credit cards. In short, there are no disputes about accepted Bitcoin payments.

Worldwide Transfers and Faster Access to Funds

Also, Bitcoin enhances worldwide transfers. This comes at a time when small e-commerce retailers, as well as other enterprises, are refraining from putting their services and products in the international market due to costly fees in transnational transactions.

However, Bitcoin lessens the high cost of global operations through facilitating faster, cheaper, and easier cross-border payments. Bitcoin further offers some protection from identity theft that banking services and credit cards fail to provide.

Lastly, having finances available at once is crucial to the existence of most small enterprises. Compared to credit card payments, Bitcoin payments make funds available to your business in a shorter time.

Regulations Linked to Accepting Bitcoin

If you have a standard business and wish to begin accepting electronic currencies like Bitcoin or other cryptocurrencies, you have to think about the legal side of this decision. Therefore, before starting the process, gather all relevant data regarding Bitcoin legalities.

Additionally, learn about the lawfulness of Bitcoin by state. To this end, it will be important to get assistance from an accountant or attorney and involve them in your decision.

How to Start Accepting Bitcoin

To begin accepting Bitcoin in your small enterprise, look for the most viable option for the kind of enterprise you own. At the moment, there are many methods with which businesses can begin accepting Bitcoin. The most straightforward options will simplify your accounting process.

For example, payment processors such as Multibit will let you begin accepting Bitcoin right away. Alternatively, open an account at Blockchain.info, where you can initiate accepting Bitcoin on your own.

However, most experts recommend starting with payment processors when you’re new to accepting Bitcoin. This is because a payment processor will help to shield you from Bitcoin’s volatile fluctuations.

Taking Bitcoin as an Individual

If you are uncertain about the suitability of accepting Bitcoin for your business, set up an account as yourself with a reputable site that handles Bitcoin exchanges. Among the well-known exchanges are Huobi, Bitfinex, BTC-E, BitStamp, and Kraken.

Next, download wallet software such as MultiBit. This is among the most popular of the desktop Bitcoin wallets. Others include Armory and Electrum. All three desktop Bitcoin wallets have a similar process.

RELATED ARTICLE: THE BEST CRYPTOCURRENCY WALLETS FOR BUSINESS

For instance, MultiBit is a Bitcoin wallet that is simple to use and enhances sending or receiving payments in the form of this virtual currency. The main benefit of MultiBit is that it can operate without downloading the whole Bitcoin blockchain.

It takes a few minutes to install MultiBit. After that, you can transfer Bitcoin payments from any person who has a Bitcoin address. It is always essential to consider security as a top priority and always lean on the side of caution. So adopt strong passwords for encrypting your Bitcoin wallet.

Making Use of Payment Processors

If your selling process is too complex to allow the direct payments of Bitcoin into a wallet, or if you run multiple dealings within your business hours, you can opt for a payment processor. Some of the popular ones include Coinbase and BitPay. Keep in mind, though, that services rendered by payment processors come with percentage fees or monthly charges.

On the other hand, when compared to PayPal or credit card charges, the prices from payment processors are by far less expensive. Besides, payment processors apply their technology, which makes it possible for you to send invoices via email, establish a point-of-sale system, or even add a shopping cart plugin to your online store. Payment processors also come in handy when looking to change Bitcoin earning into fiat currencies instantly.

Tell Your Customers You’re Now Accepting Bitcoin

Whether you are running an online platform or a bricks-and-mortar enterprise, you must tell your clients about the new payment method you are now accepting. For instance, in your business blog, you could explain the reason for the recent move to accept Bitcoin as well as its effect on your enterprise. If you have a physical location, you could put up a noticeable signboard close to the entrance as well.

Bitcoin as the Future of Online Gambling

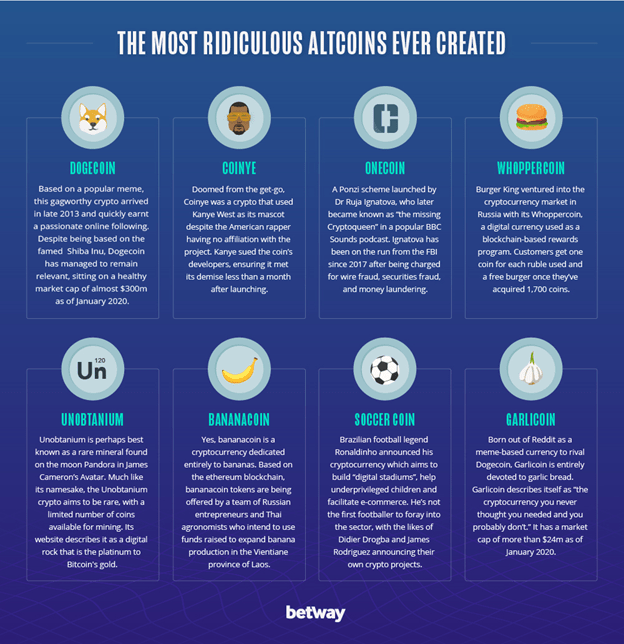

In the coming years, you may be paying for online casino games with Bitcoin, provided the sites continue assimilating this payment method. With the excellent value for Bitcoin, a famous online booker, Betway, has not been left behind. For example, it provided odds on events linked to Bitcoin around the likelihood of McDonald’s accepting this virtual currency.

As soon as you assimilate the new payment means to your business, it would be best to put the word out to your clients that you now accept Bitcoin. You can include this information in your blog posts as well as on your website.

[ad_2]

Source link

Leave a Reply