[ad_1]

There was a time when you needed to visit banks to get a commercial loan. This was a difficult time for smaller businesses. They were unable to get the loans they needed like the big companies did. But things have started to change. For one thing, the Internet has opened an easier way for new companies to reach lots of customers within a short time. For another, small- and medium-sized businesses can now depend on online lending to get the funds they need.

What’s more, online lenders have become the most sought-after alternative. This is especially true for smaller businesses. You’ll find hardly any old-school lending these days. Everything is done online instead. And both the lender and the borrower are reaping the benefits of online lending.

However, every online lending business has its share of headaches. Here we offer solutions to some problems that are common in the industry.

RELATED ARTICLE: 5 POINTERS ON HOW TO START YOUR OWN LOAN BUSINESS

Bring in Transparency

Lenders must keep track of their lending details and their sales activities. To this end, they hire employees to track these activities. They make use of spreadsheets, notebooks, accounting software, and calendars. Even so, extracting a particular piece information can be a tough job. To make matters worse, keeping track of all of the details costs money, time, and effort. This is especially the case if a business tries to do this tracking manually.

However, all this can be easily managed. What it takes is a centralized system to keep track of progress and offer forecasts. This is where online lending software such as Turnkey Lender can be of great help.

Turnkey Lender is an integrated solution. With Turnkey Lender, business owners have details about their customers at their fingertips. Moreover, the software offers transparency and quick loan processing. This helps an online lending business to provide fast, quality service. What’s more, with the help of this software, lenders can more easily achieve their goals.

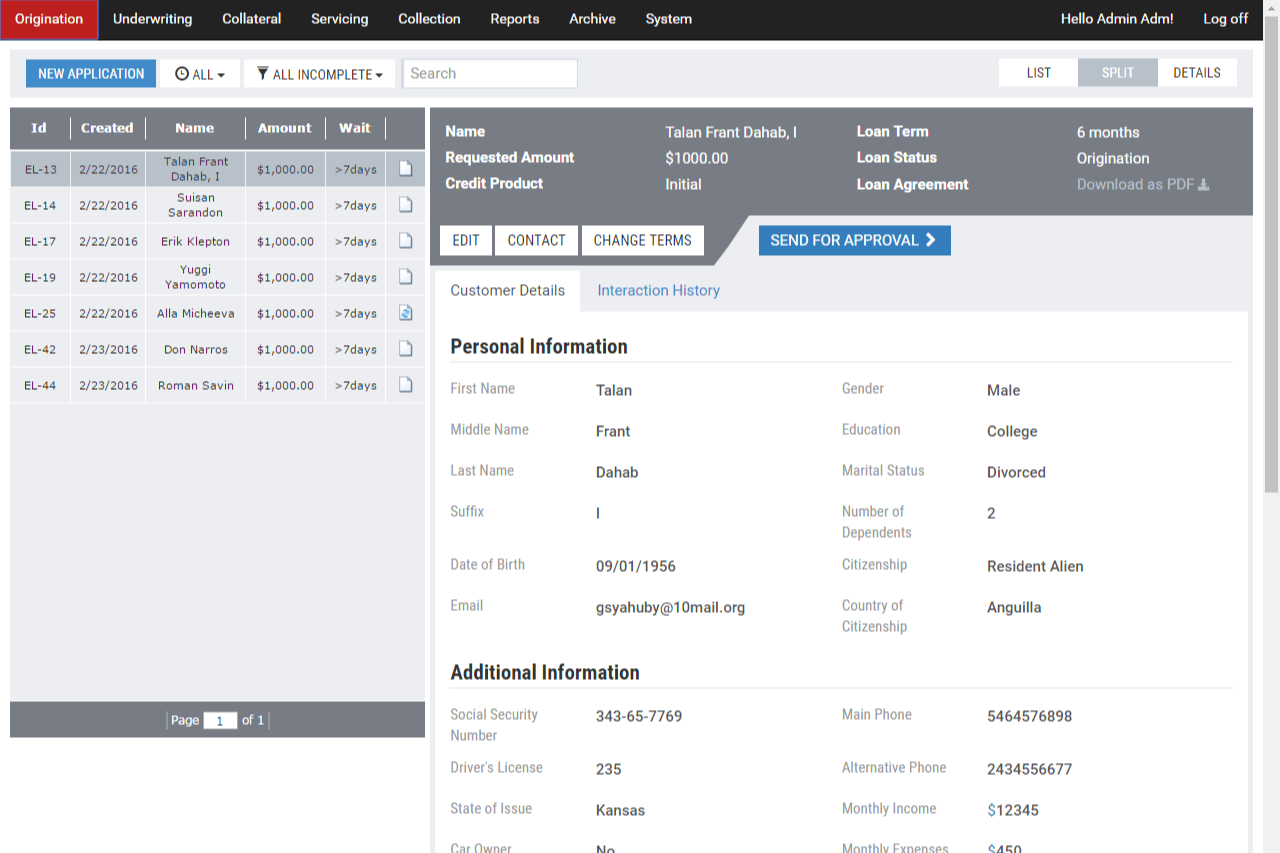

Ease the Loan Origination Process

Processing and closing loans can be a tedious job. Every loan application takes many hours to process. Furthermore, bottlenecks can slow things down. That’s because many online lenders have no systematic and comprehensive way of tracking a loan application from start to finish.

However, when an online lender uses online lending software they can better manage each loan application. What’s more, they can do so quickly. Lenders can easily see the status of any loan whenever they want to, right on their computer screens. No longer must they engage in the cumbersome and time-consuming process of trying to track loans manually. Moreover, they can use the time they save to improve the business and its profitability.

Track Critical Documents

Tracking the documents that are associated with a particular loan is another laborious task. Moreover, there is great risk for the institution as well as for the borrower if documents are mishandled.

Implement an Effective Loan Review System

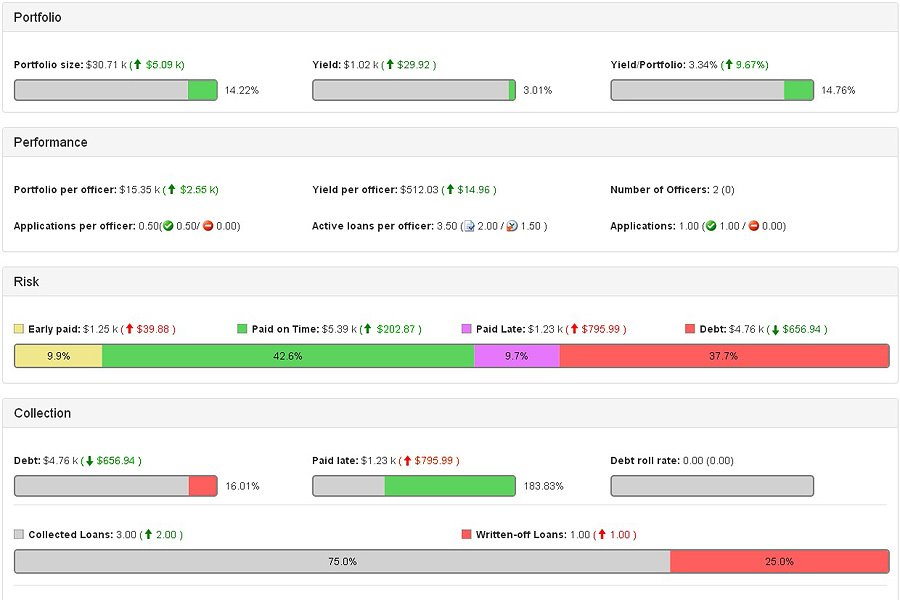

It is important to keep the financial information of the business up-to-date. This facilitates a smooth loan review system. What’s more, a company’s loan review system must always be ready to identify loans with credit weaknesses.

Additionally, the system should identify trends that affect the collectibility of the company’s portfolio. Moreover, it should assign risk grades based on the data in the system. These processes are essential for the smooth functioning of an online lending business. However, this is not possible without the help of good online lending software.

Basically, lending software streamlines loan processing and collection. It tracks activities and receipt dates for quick and easy access. For example, a borrower’s failure to update his or her financial information could suggest that he or she is facing financial difficulties. With software that notifies the business owner, the lender has a chance to quickly identify such borrowers and take quick action.

Ensure Fast Action on Default Borrowers

Online lenders must identify default borrowers promptly. That’s because too many default borrowers can cause a great deal of damage to an online lending business. To this end, online lending software quickly transfers problematic loan accounts to the company’s special service department for fast action.

Find Solutions to Your Online Lending Company’s Problems with Quality Software

In short, if you want your online lending business to be efficient and profitable, you’re going to need quality online lending software.

About the Author

Vit Arnautov is Chief Product Officer at TurnKey Lender, with special interest in fintech, credit scoring, and investments.

[ad_2]

Source link

Leave a Reply