[ad_1]

CloudBooks is specifically designed to help small businesses and freelancers manage their billing. But what makes this platform truly unique are its additional features that help with successful client management.

Relationships with clients have a direct effect on the growth and success of your small business.

That’s why many small to medium-sized businesses (SMB’s) look for ways to stay connected with their clients through marketing systems. For example many turn to a customer relationship management platform to manage face-to-face meetings between customers and salespeople. These tools can certainly improve the business-customer relationship. However, one area that business owners often overlook in this regard is accounting and billing.

RELATED ARTICLE: CRM FORECAST FOR 2019: 5 CUSTOMER RELATIONSHIP MANAGEMENT TRENDS

The way you handle finances between your business and your customers is incredibly important for creating a good relationship. For instance, if you should happen to bill a customer incorrectly or send them an inaccurate estimate report, you could damage the trust you are trying to build with them.

On the other hand, if they miss a billing cycle or are late on a payment, it could cause you frustration and eat into your profitability.

Therefore, it is important to keep all of these financial forms organized and accurate. Also, in order to simultaneously help your business grow, it is best to utilize an online system to support all of your billing and accounting processes.

CloudBooks is a great cloud-based option that is specifically designed for small businesses and freelancers for managing their billing. But what makes this platform truly unique are the additional features that help with successful client management.

Here’s how.

CloudBooks Helps You Nurture Relationships with Clients and Partners

Relationships with customers is typically an area where SMB’s shine. This is because smaller organizations can truly focus on individual customers.

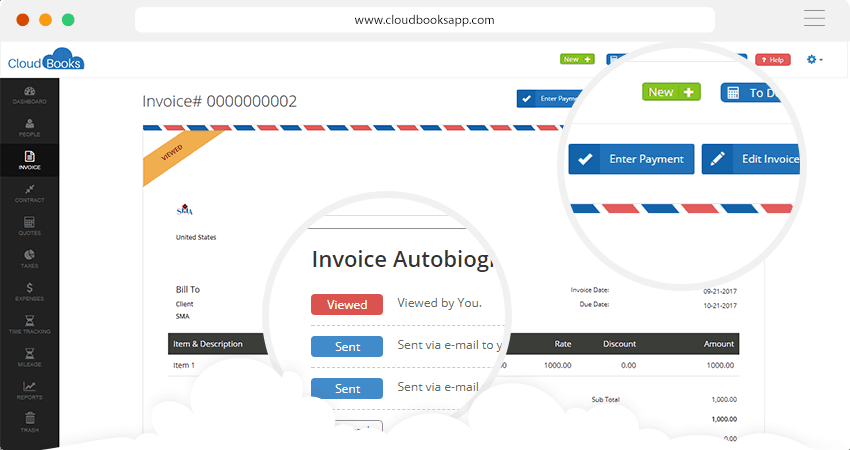

CloudBooks can help to ensure that the financial side of these relationships remains organized and available. All finance-related items are accessible from anywhere, thanks to the cloud system. This includes invoices, estimates, reimbursements, and expense reports.

Therefore, if a client needs an updated copy of an invoice, for example, you can instantly email it to them or share it with them online. What’s more, if anything changes, all of the numbers will automatically adjust in real time.

Image Source: CloudBooksApp.com

CloudBooks also offers forecasting capabilities. This allows for accurate estimates and time-tracking. In this way, your clients will know exactly how long a project will take as well as how much it will cost them.

Estimating a project is always tricky. If you overestimate, you might lose a sale. On the other hand, under-estimating could cause major issues with your client later on. CloudBooks can help you keep all of your estimates organized and itemized. Consequently, you can look to past quotes. This will help you to create more accurate estimates based on proven numbers.

Easily Schedule On-Time Payments

It is difficult for a small business to grow financially if they are

failing to collect payments in a timely manner. Furthermore, if you charge late

fees on missed payments, failing to catch these charges leaves money on the

table.

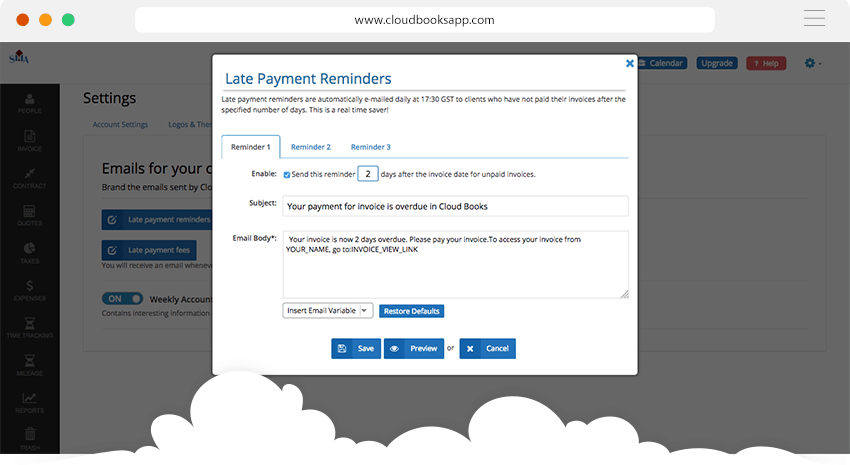

Maintaining a regular billing cycle is important for client relationships. Obviously, a customer will not be happy if they are suddenly hit with additional late fees without warning.

This is why your small business needs to utilize an organized, regularly scheduled payment system. What’s more, you need a system that will accommodate your clients’ payment agendas while keeping you on top of due dates for your accounts receivable.

With CloudBooks, it will be far easier for your small business to stay on top of client payment schedules so that you don’t miss anything. You can even send out automatic reminders to notify a client that a bill will be coming soon.

Moreover, to make things smoother for international transactions, CloudBooks offers auto billing. Plus, it is integrated with PayPal and 2checkout.

Image Source: CloudBooksApp.com

With CloudBooks You Will Get Better Feedback

Establishing a trustworthy reputation is essential for small

business growth.

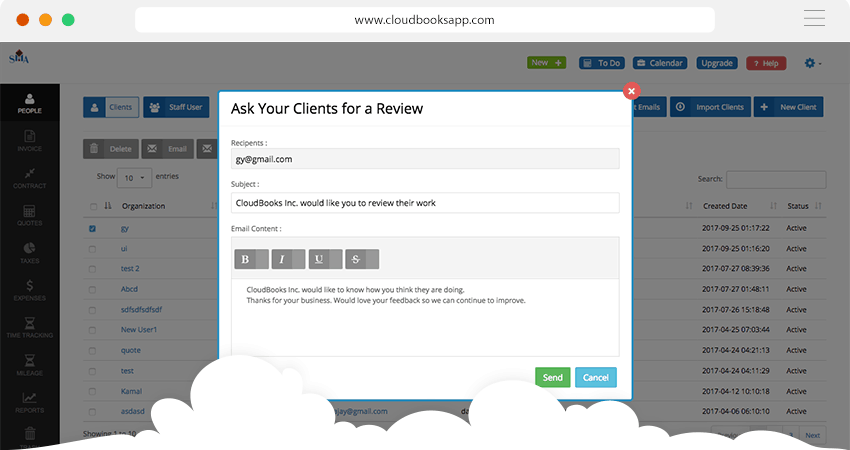

According to BrightLocal’s latest report, 86% of customers read reviews when they are considering a new small business. Also, 91% of people trust online reviews as much as they trust a personal recommendation.

Therefore, gathering lots of feedback from your clients is crucial for generating new leads. You must also pay attention to feedback you get from clients. This will help you to improve clients’ future experiences.

However, most customers are unlikely to leave a review of their own accord, unless their experience was either exceptionally great or incredibly poor. Therefore, it is best to use a review gathering system that invites all of your customers to share their honest opinions.

Image Source: CloudBooksApp.com

To this end, CloudBooks offers an automated follow-up email requesting reviews from all of your customers. This greatly increases the likelihood of receiving feedback. Post positive reviews online as social proof that your business is trustworthy. Also, be sure to scrutinize all reviews, both positive and negative, to make improvements to your business.

Monitor Your Growth for Financial Responsibility

Just because your business is attracting more clients or closing more deals does not necessarily mean that it is growing and succeeding. If your profit margins are shrinking or you are spending more on marketing in order to generate leads, your small business may actually be reverting in terms of profitability.

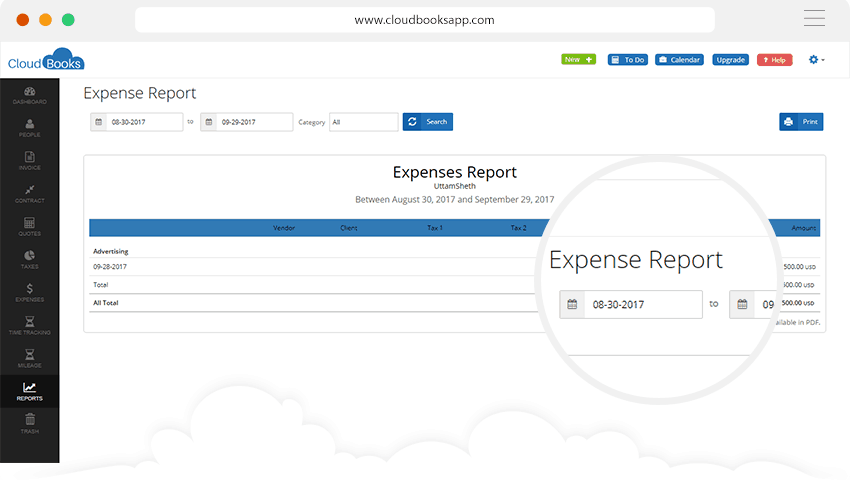

Staying on top of financial growth is key for every single business. CloudBooks is designed to help you stay on top of all aspects of your company’s margins. It does this by generating financial reports based on your accounting information. These reports will provide you with up-to-date and instant information about where your money is coming from and where it is going.

Image Source: CloudBooksApp.com

CloudBooks offers five main types of accounting reports:

- Expense reports to show where your money is being spent

- Payments collected

- Profit and loss

- Tax summaries

- PayPal payments for summaries of all online transactions with this platform

In short, CloudBooks takes the guesswork out of financial reporting by breaking down the most important metrics into easily readable reports. Use these reports for smarter planning.

Conclusion

Most small businesses feel like the cards are stacked against them when it comes to staying competitive with larger organizations.

It’s true that bigger businesses have bigger budgets for targeting more customers. They also have the ability to serve more customers due to their larger facilities and greater numbers of employees. However, small businesses do have one distinct advantage over large corporations: their ability to focus on each individual customer by creating personal relationships.

With CloudBooks, it is far easier for small businesses to nurture their financial relationships with their customers by staying on top of all payments and bills.

This platform offers truly great features for both businesses and their clients. With these features, small businesses can create a better customer experience. And this will help your company grow financially.

[ad_2]

Source link

Leave a Reply