[ad_1]

Dan Cable, professor of organizational behavior at the London Business School, argues that although managers need an element of control to get results, change efforts should happen with less work and more play. For more insights, visit Business in transformation.

[ad_2]

Source link

Involving your whole organization in the transformation journey

[ad_1]

Articles published in strategy+business do not necessarily represent the views of the member firms of the PwC network. Reviews and mentions of publications, products, or services do not constitute endorsement or recommendation for purchase.

strategy+business is published by certain member firms of the PwC network.

© PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details. Mentions of Strategy& refer to the global team of practical strategists that is integrated within the PwC network of firms. For more about Strategy&, see www.strategyand.pwc.com. No reproduction is permitted in whole or part without written permission of PwC. “strategy+business” is a trademark of PwC.

[ad_2]

Source link

Trusting the executive team during a transformation

[ad_1]

Articles published in strategy+business do not necessarily represent the views of the member firms of the PwC network. Reviews and mentions of publications, products, or services do not constitute endorsement or recommendation for purchase.

strategy+business is published by certain member firms of the PwC network.

© PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details. Mentions of Strategy& refer to the global team of practical strategists that is integrated within the PwC network of firms. For more about Strategy&, see www.strategyand.pwc.com. No reproduction is permitted in whole or part without written permission of PwC. “strategy+business” is a trademark of PwC.

[ad_2]

Source link

70Trades Is the Best Broker for Your Online Trading Activities

[ad_1]

Feature Photo by Chris Liverani on Unsplash

70Trades is one of the most well-regarded trading platforms on the Internet.

You might wonder if it’s safe to trust any online trading platform. And, while it’s true that some are merely scams, 70Trades is set up to guide you safely through the intricacies of the forex market, as well as other markets.

What’s more, you can begin trading with 70Trades with only a minimal amount, and their customer service is second to none. While you’ll need to do the work of educating yourself about trading in foreign currencies or any other market, 70Trades is a platform that can help to demystify the process for you.

In this post, we focus on how 70Trades can help you learn about and navigate the various markets, including the forex market.

Start with a Demo Account

If you’ve never traded on an online market before, then 70Trades offers you the opportunity to start your trading with a demo account. This means you can begin making practice trades without putting up any money at all.

In this way, you can begin to educate yourself about the markets and start developing your own trading strategy. This will be important when you start trading for real.

In addition, 70Trades frequently offers contests for its clients as a part of the learning process. If you enter and play well, you could win. The prize is a premium that you can use when you’re ready to begin investing actual money. As a matter of fact, this premium could be your stepping stone to your first real income as a trader.

RELATED ARTICLE: WHERE ARE THE BEST PLACES IN TEXAS TO BUY REAL ESTATE FOR RENTALS?

With 70Trades You Don’t Have to Go It Alone

At 70Trades customers always have a professional on their side when they begin their trading adventures. What’s more, this state-of-the-art online trading platform gives you access to fast-paced news sources frequently updated by the world’s leading global trading agencies.

70Trades customers from all over the world, both newbies and expert traders alike, engage on a daily basis in the forex and other trading markets. That’s because once you have registered your account at 70Trades, you’ll have access not only to forex trading but also to CFD trading as well. In addition, you’ll also be able to explore the possibility of trading in futures and commodities markets, too.

Get a Free Bonus When You Register

At 70Trades, you’ll find only the latest trading platforms. Moreover, every transaction and every process is explained in easy-to-understand terms. Best of all, when you register, you’ll automatically be eligible for a free bonus that you can use in future trades.

Choose the Market You Wish to Focus On

When you register at 70Trades, you will have full freedom to choose from among various types of trading accounts. What’s more, you’ll enjoy an array of benefits at at 70Trades, including:

- Customer service 24 hours a day and 5 days a week

- User-friendly forex trading platform

- Multilingual support: English, Arabic, and Spanish

- Easy withdrawal process

- Online trading courses

- The latest news and updates about the various markets

- Professional analyses

- Training sessions for each level

- Webinars with investors from all around the world

- A reliable and secure brokerage service

- Scam-free trading services

70Trades Is Trusted by Customers All over the World

Have you been considering the possibility of jumping into trading on the forex market, the CFD market, the futures market, or the commodities market? Most likely, what has been stopping you is uncertainty about how to make your first move. If this is true for you, let 70Trades show you the way. Before long, you could be well on your way to becoming an expert trader in whatever market you choose.

[ad_2]

Source link

Minted Grew From a Stationery Brand to a Global Design Platform. Here’s How

[ad_1]

By listening to her community and reacting quickly, Miriam Naficy built a business bigger than her wildest visions.

8 min read

This story appears in the

April 2019

issue of

Entrepreneur. Subscribe »

When Mariam Naficy launched Minted in 2008, she wanted to create a niche business, one that would crowdsource stationery designs from independent artists, ask consumers to vote for their favorites, produce and sell the best-performing creations and share a portion of revenue with the original designers.

But Naficy underestimated consumers’ interest in what she was building, and she soon found herself at the helm of a massive venture-backed design platform that was growing far beyond her original vision. So she rolled with it — adapting right alongside her company.

Now Minted’s team is 400 strong and the company is generating revenue in the “hundreds of millions of dollars.” Naficy spoke with Entrepreneur about how she’s letting the business lead the way, carefully selecting strategic partners and building a team that doesn’t require hand-holding.

Minted has been in business for 11 years. Talk to me about your original vision when you started working on it in 2007.

I was captivated by the idea of bloggers. These unknown writers were coming from nowhere, were unaffiliated with big institutions, but people wanted to read their work. I thought it was fascinating, and thought that there probably were great designers out there that the internet could also help uncover — people who are deserving but don’t know how to get their work to market. I thought that crowdsourcing designs and holding competitions was the way to do it. I raised a small round from friends and family, and we launched in 2008.

And what happened?

Not a thing sold. Not one sale for four weeks — after building this business for a year. I had launched an ecom business before — Eve.com — and products flew off the shelves immediately. But with Minted, I seriously had to consider pulling the plug. Some of my friends-and-family investors encouraged me to raise a venture round. I felt so responsible having their money on the line, so I did, reluctantly — I didn’t want any strings with this business — nut it basically saved us and gave us time.

Related: 4 Simple Ways to Use Social Media to Find ‘Warm’ Ecommerce Customers

Why do you think Minted ultimately worked?

We launched right before Instagram and Pinterest, both of which really changed the way people interact with design. Barn weddings became all the rage, for example, so our design community could just go to town, creating invitations with, say, fireflies coming out of a jar. That was wind in our sails. And oddly, the recession helped. Consumers became more interested in artisanal products than expensive brand names. And a lot of artists were out of work.

When did you really feel like you had something?

Our very first Christmas. We had such an influx of orders that we quickly hit our maximum throughput capacity and had to shut off all of our online marketing, just to slow down incoming requests. We got a call from a woman who waited on hold for two hours, and when I finally spoke to her, she said she’d been trying to track us down because she saw an ad on Google yesterday but couldn’t find it today — because we turned off paid search. I was like, Who would wait two hours to order a card? But I knew we had a real audience. And of course, we took her order.

Other than the fact that designers were hungry for work, how did you attract them to this new community?

We tried to provide validation and built a peer-critique model. During the submission process, designers can choose to get feedback and make changes before their submission gets locked in. The designs that are peer-critiqued generally score 25 percent higher than those that haven’t received feedback.

Related: Amazon Is so Powerful That Big Companies Are Producing Exclusive Brands Just for the Site

Has that helped them create their own relationships within the community?

As designer was just telling me today, a lot of designers struggle with mental health because it can be a really isolating career and there’s not a lot of validation or feedback once they leave school. So, we are bringing people together. Lately, we’ve received a lot of requests for collaboration tools that will allow them to work together and share revenues, so that’s an area we’re looking at.

Image Credit: Elizabeth Fall

You’re working more and more with large retail brands like West Elm and Target. How do you select partners?

We saw retailers copying us a lot, using us as “inspiration.” They’d actually say that: “We come to you for inspiration all the time.” But some retailers were aboveboard and asked to carry or license our designs. West Elm was the first, and they’re very artist-friendly. At the end of the day, we’re a content pipeline, and we have more content than we need. But the challenge has been where to put it — we don’t want Minted to be everywhere. So, we’ve also started alternate brands, like Pippa, which will be distributed to more mass-market stores.

You raised a $208 million Series E in December. That’s a serious number. What was your approach?

At the first stage of a business when you’re raising money, you’re selling hope, not reality, so in some ways it’s easier. At this stage, it’s all about the numbers. The people you’re talking to literally spend millions of dollars just evaluating and closing the investment. It’s a production. But I’ve raised about $330 million in my career, and I’ve learned one thing: You have to focus on your intuition. Do you trust these investors, and is there value-add? For example, Henry Ellenbogen from T. Rowe Price is a great strategic thinker, and very into branding for a financial investor, so that’s super value-add. [Editor’s note: Ellenbogen has since left T. Rowe Price to launch his own venture.]

I always hear great things about him.

He recently gave me a great piece of advice that I’ve put into practice: Out of all your direct reports, have two that you’re focused on developing. You’re never going to have time to develop your entire staff — you have to hire people who have already seen the scale you’re at. But pick two who haven’t seen the scale, and mentor them.

Related: Vegan Celebrity Chef Chloe Coscarelli Says Entrepreneurs Should Push for Change Even When No One Believes in Them

That’s probably really helpful once you’re working with a team of this size.

We have about 400 employees, and it’s tricky to build as we move into new categories. When do you hire full-time employees against a new idea? You don’t want to necessarily build a team before you know if something will be successful. I was studying how Steve Jobs formed Apple retail. He hired Ron Johnson, they figured it out together; and then he immediately delegated [that division] to Ron, rather than setting up retail and then having to hire someone.

Is that your approach now?

I’m looking at potentially launching physical stores, so I’m facing this conundrum: I’ve got to hire someone and entrepreneur this with them so they can take the reins and I can focus on other areas. Our recent capital raise will help. That’s been another critical learning: Being cheap is not always the answer. You will hurt yourself by being too profitability focused. There is a point where you have to invest ahead of the data.

After more than a decade building the Minted community and model, you’re sitting on a ton of data. How does that drive the business?

It gives us the road map. It’s predictive analytics. It’s been 10 years of [collecting data on] what segments of people — based on things like age groups or socioeconomic factors — are more predictive [voters] for which product categories. And then we use a look-alike model. So, if someone has the same attributes as someone who successfully voted in the past, that’s the person we’re trying to get to vote in this new competition, and we weigh those votes more heavily. We’ve scaled the production of best-selling design hits, creating a retail brand that is literally on-trend every year.

That’s a big leap from your original vision.

I thought I founded a cash-flow stationery retailer, but it’s really a content studio. The business has shown me the way. It’s unrecognizable from where we started. I don’t blame anybody who didn’t invest in us in the first round, because we had no idea this was going to happen.

[ad_2]

Source link

6 Tips from the Experts

[ad_1]

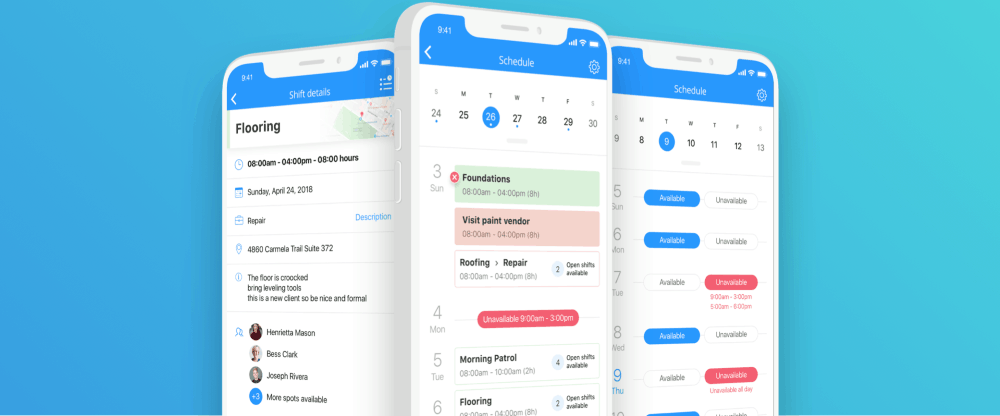

Creating a balanced and fair schedule for your workforce might seem like a far-fetched dream. However, it is possible to make this a reality.

Having the perfect work schedule in place keeps you and your staff happy. Moreover, it boosts efficiency and profits at the same time. But how can you achieve such perfection? We’ve laid out the six tips you need to create employee-friendly workforce scheduling.

1. Be Accurate in Your Projections

When creating a schedule for your workforce, you need to anticipate the number of work hours your staff will need to complete the work that needs to be completed. Also, you need to take into account by when that work needs to be done.

Consider things like business growth, holiday peaks, and fluctuations in sales to adjust your staffing projections. Fine-tune the schedule as the situation changes.

2. Create Balance in Your Workforce

Make sure there is balance in the staff. For example, if you have a lot of new and inexperienced employees in your workforce, it can create stress on the staff and lead to unhappy customers. Therefore, make sure there are experienced staff on the schedule for each shift, along with supervisors, to keep the business running smoothly.

RELATED ARTICLE: NEED EMPLOYEE TRAINING ASAP? WHY ONLINE TRAINING IS THE BEST SOLUTION

3. Get It Done Ahead of Time

Your employees need time to review the schedule. Therefore, aim for completing each week’s schedule about two weeks in advance. This way, members of your workforce will have plenty of time to schedule their personal life around their work life.

Also, if extra hours become available, or the schedule needs to change for any reason, make sure everyone on your workforce is aware of those changes.

4. Know Who Your Employees Are

When you’re creating a schedule for your workforce, it is important to know your employees. For instance, a younger employee or college student might prefer night hours or a similar arrangement. On the other hand, parents likely appreciate nights off to be with their children. By creating a schedule that works for everyone, you will have happier employees. And that always translates to happier customers.

5. Make Shift Changes Easy for Your Workforce

Employees need an easy process for swapping shifts when they need to. Therefore, make sure you have clear procedures in place. This will help to avoid confusion. For instance, an employee handbook can help to easily outline the steps, such as clarifying who on the workforce needs to be informed about any changes. Also, it can let employees know how much time in advance they need to make their requests for changes to the schedule.

6. Use an Online Solution

To make scheduling easy, accurate, and quick to access, get the best employee scheduling app available. And that is Connecteam. With this easy-to-use app, you can create single, multiple, or team shifts. Or you can upload shifts in bulk with an Excel file.

Save time when you’re creating schedules for your workforce. Also, get more daily operations completed at the same time. How? Simply use Connecteam’s calendar view. It allows you drag-and-drop options, and you can easily copy the previous week’s shifts.

Does your team work recurring shifts? Or do you dispatch per jobs, clients, or projects? Whatever your scheduling needs are, you’re covered.

Plus, as soon as you publish a schedule, relevant employees receive a push notification that lets them know about it. Then, as a manager, you can see who viewed the schedule and who didn’t. Additionally, every time an employee clocks in or out, the software tags their GPS location. This helps to prevent buddy punching.

Connecteam is available for a fixed monthly price, with plans starting at $29 a month. If you need it, however, there’s a plan at $72 a month for up to 200 users. In other words, you don’t need to pay per user to benefit from all the features this workforce scheduling app has to offer. Start a free 21-day trial now.

Treat Your

Workforce Right with Employee-Friendly Scheduling

Create an enjoyable and friendly work environment by applying the six points we laid out above. All of this will lead to happier employees and therefore happier customers. And that is a real win-win.

[ad_2]

Source link

Cyber Attacks Cost Small Businesses $53,987 on Average, Survey Claims

[ad_1]

Cybersecurity remains one of the most challenging issues for small business owners. And the problem leads small business owners to seek out managed service providers to present them with solutions.

But a new report from Continuum says the state of cybersecurity among small businesses in 2019 still needs to improve. The data suggests great opportunities for service providers who offer cyber security as part of their package. And predicts troubles for those who don’t.

The reason MSPs are so important for small businesses is many providers offer a one-stop shop for all things IT. However, some providers don’t include cyber security. And as the report reveals, SMBs are holding MSPs accountable when a security breach takes place, whether they provide security solutions or not.

In the press release, Michael George, CEO, Continuum, addressed this very issue in the press release. George said, “Businesses expect to be protected by their MSPs, and are ready to pay more for that protection – whether from their existing MSP or by switching to a provider that promises a better solution.”

Opportunities for Managed Service Security Providers

Businesses now have a better understanding of the digital ecosystem they operate in and the cybersecurity threats they face. The increased awareness has resulted in looking for and implementing the best system possible to protect their digital assets.

For MSPs providing cyber security as part of their service, this means more opportunities. George said, “If MSPs can deliver the right cybersecurity solutions to their end-clients, they will hold the competitive advantage in the SMB market.”

In the US close to half or 47% of SMBs said they would pay at least 20% more from a new provider if they have the right cyber security solution. Overall small businesses are willing to pay 24% more on average for the right cyber security solution.

An even more startling finding is 93% would consider moving to a new provider if they have the right cyber security offering.

The growth opportunity for MSPs providing cybersecurity is on the upside. The report says 77% of the businesses in the survey expect to outsource at least half of their cybersecurity needs in five years’ time. In the near term, 78% are planning to invest more in cybersecurity in the next 12 months.

Worsening Cybersecurity Threat

Cyber attacks cost small businesses in the survey $53,987 on average. Large organizations lost more money.

Companies with 10-49 employees lost $41,269 and those with 50-249 employees were in the hole for $48,686. Those with 250-1,000 employees ended up losing $64,085 per incident.

The cyber threat landscape is getting worse. The good news is small businesses are more aware of this fact, but not everyone is.

In the survey, more than 6 in 10 or 62% of the organization don’t have an in-house expert to properly deal with security issues. Only 41% currently have cybersecurity experts in-house.

The Survey

Continuum commissioned Vanson Bourne to conduct the 2019 State of SMB Cyber Security report research. It was carried out between January and March 2019.

A total of 850 IT and business decision makers involved in cybersecurity as part of their organization took part in the survey. The organizations represented a number of core industries across different sectors in the US, UK, France, Germany and Belgium

Image: Depositphotos.com

This article, “Cyber Attacks Cost Small Businesses $53,987 on Average, Survey Claims” was first published on Small Business Trends

[ad_2]

Source link

With Overdraft Charges Banks Win and You Lose: Don’t Be a Victim

[ad_1]

Featured Image from Pixabay on Pexels

Who hasn’t been stung by a surprise overdraft charge? Judging by the sums banks are collecting in overdraft charges, it’s clearly a big problem, both for individuals and for small businesses. As a matter of fact, in 2017 Americans paid a total of $34 billion in overdraft charges. And that’s a lot of money.

There are two reasons for this large amount. First, millions of people pay overdraft charges for a range of avoidable reasons. Next, these charges have been increasing over the years. At the turn of the millennium, for example, they hovered around $20. But today, they’re commonly about $35.

Overdraft Charges Can Be Extremely Painful

An overdraft charge of $35 might seem harmless enough, but it really isn’t. The problem lies in the fact that the effective interest rate of a $35 overdraft fee is extremely high. Just spent $10 at the supermarket? The implied APR of a $35 charge is huge.

Where matters get far worse is when a checking account suffers from multiple overdraft charges. Let’s say you spent the day making several small payments with your debit card. Each payment can trigger a further overdraft fee, and you could end up with more than $100 dollars in overdraft charges just by making a couple of small payments.

Don’t Be a Victim

Consumers who get stung by high overdraft charges don’t necessarily find themselves in that position because they have no other choice. Instead, high overdraft charges are often the result of a degree of negligence from the side of the checking account holder.

Banks offer services such as “overdraft protection” because they know that their clients will fall into the trap of paying overdraft fees. However, as much as overdraft protection sounds like a way to save your finances, it is more likely to cost you significantly in the long run. But how can you avoid being a victim of high overdraft charges?

Act Quickly

We mentioned how repeated overdraft charges can quickly add up. The best way to ward off the worst effects of these fees is to make sure you correct a negative balance as quickly as possible.

First, ensure you get a warning: Enable any low balance alerts, and enable an overdraft alert if you have the option to do so. Alternatively, make sure you check your account balance regularly so that you spot when you have overdrawn your account, or if you are in danger of overdrawing it.

Next, react quickly when you overdraw your account so that you can prevent further overdraft charges. Transfer spare cash if you have cash available or consider borrowing to top up your checking account.

Plenty of overdraft apps can give you a small loan at low or even no cost. The Overdraft Apps site reviews all the popular overdraft apps. There’s a good chance one of these can help you out at a far lower cost than the cost of an actual overdraft.

RELATED ARTICLE: MANAGE YOUR FINANCES AND STAY DEBT-FREE WITH THESE TIPS

Plan Ahead

As we mentioned earlier in this article, banks know that checking account customers are lackadaisical about their financial management habits. And banks cash in on the resulting overdraft fees. However, it’s easy to steer clear of these fees.

Simply get better at financial planning. The key to preventing overdrafts lies in ensuring that you don’t spend more than your income. In fact, you should attempt to spend a bit less so that you can build a buffer of savings.

Photo by rawpixel.com from Pexels

A Final Word About Overdraft Charges

However, it’s not just cash flow planning that can save you from overdrafts. Consider opting out of your bank’s overdraft protection service. Sure, you could end up getting some transactions declined, but that’s not the end of the world.

If you really struggle with overdraft fees you could also choose to make use of a prepaid debit card instead of paying with your checking account debit card. With a prepaid card, you’ll simply get a transaction declined if you’re out of funds, instead of having an expensive overdraft charge.

[ad_2]

Source link

6 Things You Need to Know About Being a Trade Show Exhibitor

[ad_1]

There’s a huge difference between attending a trade show and being a trade

show exhibitor. If you’ve never stood on the other side of the booth, there are

some things you probably don’t know about the experience.

RELATED ARTICLE: THE BEST GIVEAWAY ITEMS FOR MARKETING YOUR HOME-BASED BUSINESS

The Lowdown on Being a Trade Show

Exhibitor

If you’ve never attended a trade show as a trade show exhibitor, you aren’t

fully aware of how catalytic trade shows can be for businesses that are

pursuing exposure, growth, and sales. Some of the key benefits of trade shows include:

Brand Exposure

For one, a trade show can enhance your brand’s exposure. Even if people don’t stop by your booth, they’ll still see your brand name or logo. And this is something that could influence a decision down the road.

Relationships

There’s a powerful networking component to trade shows that brands can

benefit from. Whether it’s a one-day event or a week-long show, rubbing

shoulders with others in the industry gives you a more powerful network.

Lead Generation

There’s nothing like being able to communicate and engage with your target

customers in a face-to-face manner. In terms of lead generation, this is like

tossing gasoline onto a simmering fire: It accelerates the process and improves

your chances of generating significant results.

Every business will have its own trade show experience, but it’s hard to

overlook these three benefits.

However, if you want to increase your chances of having a successful

experience, you need to be aware of what you’re getting yourself into.

Tips and Tricks for Being a Successful Trade Show

Exhibitor

Here are some tips and tricks that have been curated with the first-time

trade show exhibitor in mind:

1. Register Early

Try to register for a trade show as early as possible. Not only is there

limited space at most events, but you’ll also find early-bird pricing.

Moreover, this can be as much as 15 to 25 percent cheaper than standard

pricing. Furthermore, you’ll give yourself more time to plan and invest in

pre-trade-show marketing and promotion.

2. Choose a Good Location

The location of your booth at a trade show will have a direct effect on your

ability to engage people. At some trade shows, most booth spaces will be

created equal. However, at other shows, there’s a significant disparity between

the best and worst booths. Good booths are located near restrooms, concessions,

or points of entry. Bad booths are tucked away from the main avenues.

3. Design a Compelling Booth

Booth design is important for a number of reasons. First off, it helps you generate attention and bring people into your booth. Secondly, it allows you to articulate your branding and develop a specific emotional response. Be sure to invest

in quality trade show displays so that you’re able to use them over and

over again.

4. Staff the Right People

A compelling booth located in a conspicuous area will bring people into your booth. But once they’ve shown up, you need the right reps to interact with them and start the process of qualifying and converting leads. Choose people who are gregarious, experienced, and familiar with the ins and outs of your brand.

RELATED ARTICLE: HOW TO GROW YOUR BUSINESS BY FOSTERING A TEAM MENTALITY

5. Collect Information

You never want someone to visit your booth, interact with your reps, and walk away without leaving you their information. Moreover, it’s impossible to generate warm leads without having a system in place for collecting data. Even if it’s as simple as a name and email address on a note card, every trade show exhibitor needs a system.

6. Get Out and Network

Don’t spend all of your time sitting at your booth. Even if you’re

interacting with prospective customers, every trade show exhibitor has

additional responsibilities. So while your brand reps stay behind, go out and

network with other business leaders. This is a perfect opportunity to grow your

professional network and get a pulse on your industry as a whole.

Sign Up for Your First Experience as a

Trade Show Exhibitor

Trade shows may or may not be extremely effective for your business. It all

depends on the industry you’re in, what your main focus is, and how your

customers move through the purchase process. However, you won’t know until you

try. Sign up

for a trade show this year and give it your best shot. There’s a lot to

like about being a trade show exhibitor!

[ad_2]

Source link

How to Eliminate Salary Negotiation Anxiety

[ad_1]

As long as you’ve done research to learn a realistic salary range to ask for and have a plan in place for navigating the negotiation, there’s nothing to worry about.

2 min read

This story originally appeared on Glassdoor

Salary negotiation doesn’t have to feel uncertain or intimidating. As long as you’ve done research to learn a realistic salary range to ask for and have a plan in place for navigating the negotiation, there’s nothing to worry about.

In our eBook “How to Negotiate Your Salary” we offer tips will also help you to have effective salary negotiations:

1. Have a salary range rather than a single figure.

When pressed for your salary requirements, you should always be sure to offer a range based on what others in the field are earning, rather than a single fixed number.

2. Don’t sell yourself short.

One common mistake when talking about the previous salary is forgetting to include benefits as part of your total compensation, said author Don Hurzeler. For example, if you are earning $100,000 a year with a 20 percent bonus plus health, dental and other incidental benefits, you should answer the question by saying, “$120,000 plus generous benefits.”

3. Practice your pitch at least once before the actual negotiation.

Find someone to listen to your proposal for a salary increase, so you can feel the cadence of your speaking points out loud in a conversational setting.

4. Be gracious.

No matter the outcome, be understanding, appreciative and thankful for the opportunity.

5. Be confident in your delivery.

It’s extremely important to put on your game face when it comes time to negotiate.

6. Avoid accepting the first offer.

If you need time to evaluate an offer, say so. Schedule your next meeting 24 to 48 hours out and come back with your counteroffer.

Before your next salary negotiation — whether for a new job or as your lobby for a promotion — learn what to say, how to make a strong case, anticipate your manager’s questions and ultimately seal the deal.

[ad_2]

Source link

- « Previous Page

- 1

- …

- 102

- 103

- 104

- 105

- 106

- …

- 172

- Next Page »